Ensuring compliance with Beneficial Ownership Information (BOI) is essential for businesses. Here’s a comprehensive guide to help you understand the key aspects of BOI filing.

What is BOI?

BOI stands for Beneficial Ownership Information, which refers to the details of individuals who own or control a company, directly or indirectly.

This information is crucial for identifying the true owners behind a business entity, enhancing transparency and accountability.

The Corporate Transparency Act, passed in 2021, requires companies to report this information to the U.S. Department of the Treasury.

The BOI report is a one-time filing, unless there are changes to the company’s information or beneficial ownership.

If there are changes, an updated BOI report must be filed within 30 days.

Why Report BOI?

The Corporate Transparency Act, passed in 2021, mandates BOI reporting to combat illicit activities such as money laundering and terrorism financing.

By reporting BOI, companies help ensure a transparent business environment, making it harder for bad actors to misuse corporate structures for illegal purposes.

Who Needs to Report BOI?

BOI reports are required for nonexempt corporations, partnerships, and limited liability companies (LLCs).

The report discloses information about the company and its beneficial owners, which are individuals who own at least 25% of the company’s equity or have substantial control over it.

- Limited liability companies (LLCs): Include single member LLC owner

- Corporations: Include S-Corporation

- Other entities formed by filing a document with a Secretary of State or similar office. Certain entities, like publicly traded companies, may be exempt from this requirement.

What is the Process?

Gather Information

- Full name, date of birth, residential addresse, and Social Security Number (SSN) or Tax Identification Number (TIN) of beneficial owners, along with details of ownership or control percentages.

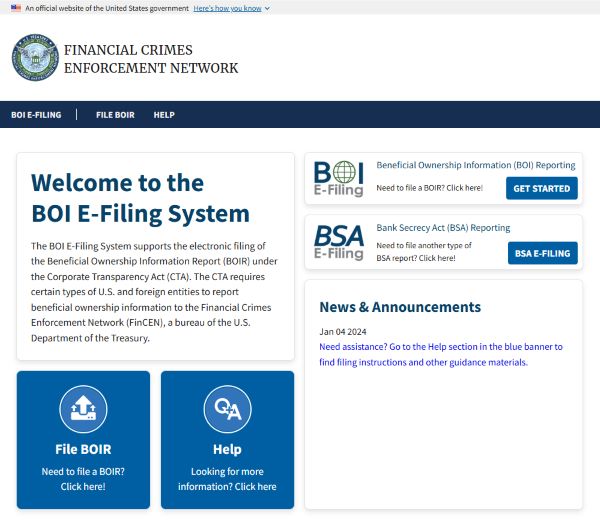

File Electronically

You can submit the BOI through FinCEN’s secure E-Filing system.

- For companies created before January 1, 2024: Initial BOI report due by January 1, 2025.

- For companies created in 2024: Report within 90 days of effective notice.

- For companies created on or after January 1, 2025: Report within 30 days of effective notice.

No Filing Fee

There is no cost to submit BOI report.

Penalties for Failing to file BOI

Civil Penalties

As of January 25, 2024, the civil penalty for each day of late filing is $591, up from $500.

Criminal Penalties

For willful violations, the criminal penalty can include up to two years in prison and a fine of up to $10,000.

Conclusion

Ensuring accurate and timely BOI reporting helps maintain compliance, avoid penalties, and contribute to a transparent and trustworthy business environment.

While many companies can file BOI themselves, professional assistance from attorneys or accountants can be sought for more complex situations.